** All our trades are verifiable with our brokerage Robinhood, there is nothing to hide ! All about RESULTS!**

Do you want to get FREE stock today? If so, click on the link here. There are no gimmicks.

AMZN TRADE: $395 to $1725

336% return!

LULU TRADE: $920 to $6,000

This trade was initiated May 31, 2018, in which I bought 10 call option contracts of LULU options at $0.92 , it cost me $920. I ended up closing the trade at $6.00 per contract, with a profit of $5,080. I love options trading as you can gain profits really quickly, if you know what you are doing, and enter a trade at the appropriate time. I usually trade during earnings, which are when companies release their financial reports publicly to the market and the market either rewards them with a higher or lower stock price. On May 31, 2018, LULU released their earnings report for that quarter; the report was great and the stock shot up about 7% and continuing rising the day after. Before earnings, the stock price closed at $105.05 and the following day after earnings, the stock priced closed at $122.19. That price movement was huge and it reflected in the profits in my call options.

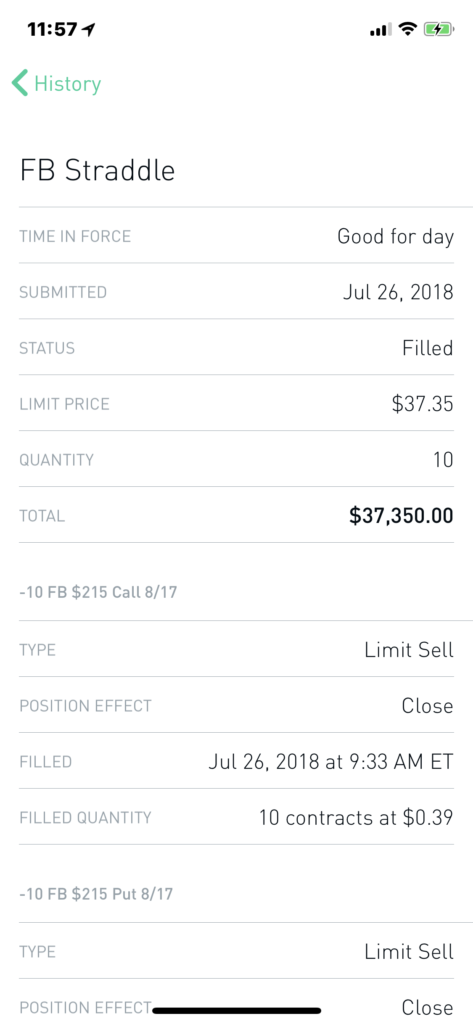

BIGGEST ONE DAY TRADE: $15,000 to $37,350

Biggest one day trade I ever had was on FB (Facebook) stock. This trade was also an earnings trade, but in this trade, I used an options strategy called a straddle. A straddle is a direction neutral trade in which one can make money if the underlying moves up or down drastically. On July 25 2018, FB reported its financial report and missed the streets estimates, in other words, its report did not live up to expectation. The stock plunge over 20% that day and some more the following day and I was able to capitalize on that. I entered my straddle on July 25, 2018 earlier in the day before the earnings report came out. I entered with 10 contracts at $15.00, which cost be $15,000. I closed out that position the following day at $37.35 per contract, with a profit of $22,350.

Yelp Trade: $970 to $5,000

I entered a trade on Aug 8, 2018 on YELP. On this trade, I took a bullish bias after looking at the financial statements of the company and bought 10 call contracts at 0.97, it cost me $970. I ended up selling it on Aug 9, 2018 at $5.00 per contract, with a profit of $4,030.

ZOES-Zoe’s Kitchen Straddle Trade: $3,460 to $5,500

I put on a straddle trade on Zoe’s Kitchen on August 16 2018 before it reported its earnings after the market closed that day. I entered the position with 20 contracts at $1.75 and closed the position at $2.75 per contract, for a gain of +$2,040.

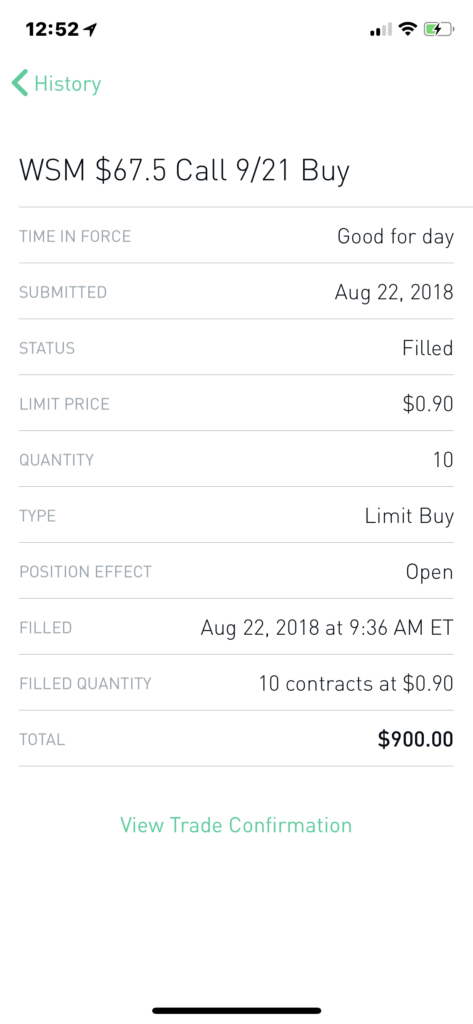

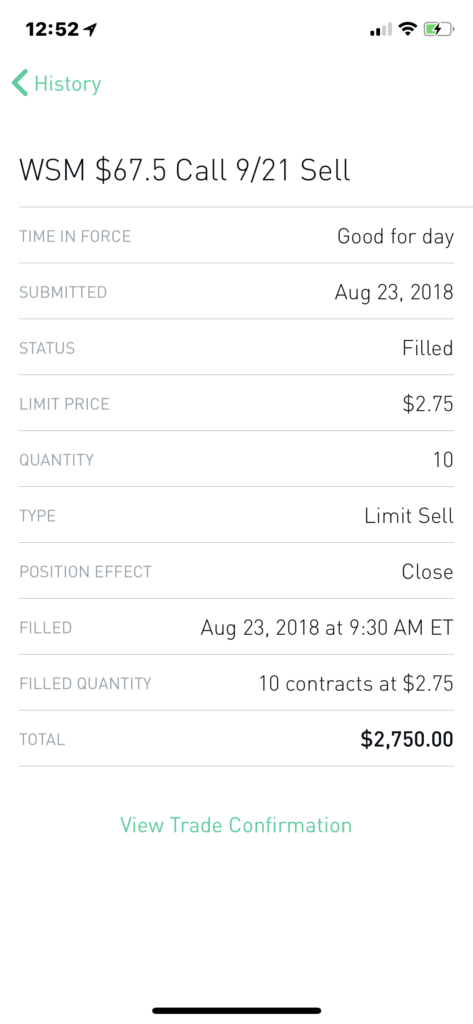

WSM Trade: $900 to $2,750

On this trade, which was an earnings trade, I was bullish on WSM and decide to get some call option contracts. I entered the trade with 10 contracts at 0.90 per contract, for a total cost of $900. I closed the trade at $2.75 per contract, with a profit of $1,850, a 206% return !

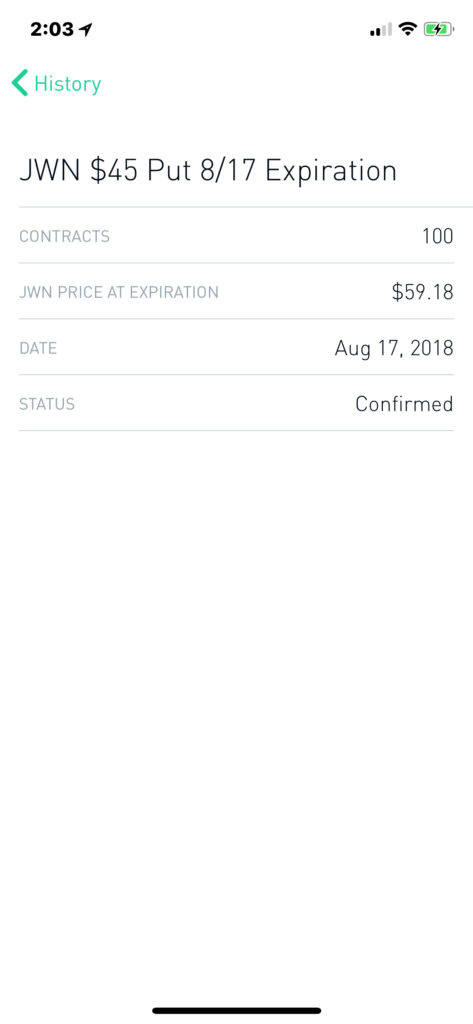

Losing Trade- Losing $1600 in one trade

Yes, you can make a lot of money trading options, but you can also loose a lot of money trading options. For me, I have made more than I have lost and even if I do loose some trades, it is very minimal. Losing is part of trading, however, the goal is to minimize risks and use option strategies that will help accomplish such goals. There was a trade I put on August 16 2018 on JWN (Nordstrom). After market closed at 4pm, the company was to report their financial earnings. After doing my research, I decided to buy some put contracts as I believed the price of the stock would go down. However, that’s was a big mistake as I missed the retail turnaround trend and failed to pay attention to the government’s retail report. The retail industry had been improving and I failed to pay attention to it and it cost me. I bought the 45 strike Put expiring 8/17; I bought 100 contracts at 0.16, my cost was $1,600. In order for me to make money on this trade, the stock had to go below (45-0.16=44.84). However, the companies report was so good that the stock skyrocketed to about $59. So that contract expired worthless

SFIX Trade: $1370 to $2720

We executed a straddle play on SFIX and were able to capitalize on this trade. We realized a 98.5% return on the trade.

SFIX reported its financial earnings report Oct 1 2018 and the report was not well received by the market.